Loans For Bad Credit: Accessing Financial Solutions For Poor Credit Scores

Loans for bad credit offer a lifeline to individuals with poor credit scores, providing crucial financial support when traditional options are limited. This comprehensive guide explores the intricacies of bad credit loans, shedding light on the various types available, key considerations before applying, and the potential risks and benefits involved.

Overview of Loans for Bad Credit

Loans for bad credit are financial products designed specifically for individuals with poor credit scores. These loans differ from traditional loans in that they are tailored to meet the needs of borrowers who may have difficulty obtaining approval from conventional lenders due to their credit history.

Typical Features and Requirements of Loans for Bad Credit

Bad credit loans typically come with higher interest rates compared to traditional loans, reflecting the higher risk associated with lending to individuals with poor credit. These loans may also have lower borrowing limits and shorter repayment terms.

- Minimum credit score requirements are often more lenient for bad credit loans, making them accessible to individuals with subpar credit ratings.

- Collateral may be required for certain bad credit loans to mitigate the lender’s risk.

- Some bad credit loans may have additional fees or charges to offset the increased risk to the lender.

Importance of Bad Credit Loans

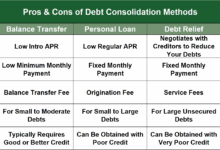

Bad credit loans play a crucial role in providing financial assistance to individuals who may have limited options due to their credit history. These loans offer a lifeline to those who need access to funds for emergencies, major purchases, or debt consolidation.

Types of Loans Available for Bad Credit

When it comes to obtaining a loan with bad credit, there are several options available to individuals. These loans are specifically designed to cater to those who may have a low credit score or a less than perfect credit history. Here, we will explore the various types of loans available for bad credit borrowers.

Secured vs Unsecured Bad Credit Loans

Secured bad credit loans require collateral, such as a car or home, to secure the loan. This reduces the risk for the lender, making it easier for individuals with bad credit to qualify. On the other hand, unsecured bad credit loans do not require collateral, but they often come with higher interest rates to compensate for the increased risk to the lender.

Payday Loans

Payday loans are short-term loans that are typically due on the borrower’s next payday. These loans are easy to qualify for, but they often come with extremely high interest rates, making them a costly option for borrowing money.

Installment Loans

Installment loans allow borrowers to repay the loan amount in fixed monthly installments over a set period of time. These loans can be more manageable than payday loans, as the repayment terms are spread out over a longer period.

Personal Loans for Bad Credit

Personal loans for bad credit are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. While these loans may have higher interest rates than traditional personal loans, they can still provide a valuable source of funding for individuals with bad credit.

Factors to Consider When Applying for Loans with Bad Credit

When applying for loans with bad credit, there are several key factors that individuals should consider to increase their chances of approval and secure favorable terms.

Impact of Interest Rates on Bad Credit Loans

Interest rates play a significant role in bad credit loans as they determine the overall cost of borrowing. Individuals with bad credit are likely to face higher interest rates compared to those with good credit scores. It is essential to carefully evaluate the interest rates offered by different lenders and choose the most competitive option to minimize the long-term financial burden.

Tips to Improve Approval Chances for Bad Credit Loans

- Check and Improve Credit Score: Before applying for a bad credit loan, individuals should review their credit report for any errors and take steps to improve their credit score if possible.

- Provide Collateral: Offering collateral can increase the chances of approval for a bad credit loan as it reduces the lender’s risk.

- Apply with a Co-Signer: Having a co-signer with good credit can help boost the chances of approval for a bad credit loan and secure better terms.

- Compare Lenders: It is important to shop around and compare offers from different lenders to find the most suitable option for your financial needs.

- Prepare a Strong Application: Put together a comprehensive application that highlights your income, employment stability, and ability to repay the loan to make a positive impression on lenders.

Risks and Benefits of Bad Credit Loans

When considering taking out a loan for bad credit, it is essential to weigh the potential risks and benefits involved. While these loans can offer a lifeline to individuals in need of financial assistance, there are also important factors to consider in order to make an informed decision.

Risks Associated with Bad Credit Loans

- Higher Interest Rates: Loans for bad credit often come with higher interest rates compared to traditional loans, which can significantly increase the overall cost of borrowing.

- Increased Fees: Lenders may impose additional fees and charges for bad credit loans, further adding to the financial burden on borrowers.

- Impact on Credit Score: Failing to repay a bad credit loan on time can further damage your credit score, making it harder to access credit in the future.

- Potential for Predatory Lending: Some lenders targeting individuals with bad credit may engage in predatory practices, leading to a cycle of debt for borrowers.

Benefits of Bad Credit Loans

- Access to Funds: Bad credit loans provide a way for individuals with poor credit to access much-needed funds in times of financial need.

- Opportunity to Improve Credit: By making timely repayments on a bad credit loan, borrowers can start rebuilding their credit score over time.

- Flexible Approval Criteria: Lenders offering bad credit loans may have more lenient approval criteria, making it easier for individuals with bad credit to qualify for a loan.

Impact on Credit Scores and Financial Stability

Bad credit loans can have both positive and negative impacts on credit scores and financial stability. While timely repayments can help improve credit scores, failure to repay can worsen the situation. It is crucial for borrowers to carefully consider their financial situation and ability to repay before taking out a bad credit loan.

Closing Notes

In conclusion, loans for bad credit serve as a valuable tool for those in need of financial assistance, offering a pathway to improved credit scores and enhanced financial stability. By understanding the nuances of bad credit loans, individuals can make informed decisions to secure their financial future.