Low Interest Personal Loans: A Guide To Affordable Borrowing

Low interest personal loans offer a cost-effective way to borrow money, providing numerous benefits and advantages over other types of loans. Dive into this comprehensive guide to discover how you can secure the best rates and terms for your financial needs.

Overview of Low Interest Personal Loans

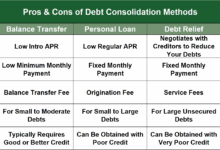

Low-interest personal loans are a type of loan that comes with lower interest rates compared to other forms of financing, such as credit cards or payday loans. These loans are typically unsecured, meaning they do not require collateral, and are often used for various personal expenses like home renovations, medical bills, or debt consolidation.

Benefits of Opting for a Low-Interest Personal Loan

- Lower Interest Rates: Low-interest personal loans offer borrowers the advantage of paying less in interest over the life of the loan compared to high-interest loans.

- Predictable Monthly Payments: With fixed interest rates, borrowers can budget more effectively since their monthly payments remain the same throughout the loan term.

- Flexible Use of Funds: Borrowers can use the funds from a low-interest personal loan for a wide range of purposes without restrictions.

Typical Interest Rates Associated with Low-Interest Personal Loans

Low-interest personal loans usually come with interest rates ranging from around 5% to 15%, depending on the borrower’s creditworthiness, loan amount, and the lender’s terms. It’s essential to shop around and compare offers to secure the best rate possible.

Factors Affecting Interest Rates

When it comes to determining the interest rates for personal loans, lenders take various factors into account to assess the risk associated with lending money. One of the key factors that significantly influences the interest rate offered is the borrower’s credit score. Additionally, the type of interest rate, whether fixed or variable, also plays a crucial role in determining the overall cost of borrowing.

Credit Scores Impact

Credit scores have a direct impact on the interest rates offered on personal loans. Borrowers with higher credit scores are considered less risky by lenders and, therefore, are typically offered lower interest rates. On the other hand, individuals with lower credit scores may face higher interest rates or even struggle to qualify for a loan. Lenders use credit scores as a tool to assess the borrower’s creditworthiness and ability to repay the loan on time.

Fixed vs. Variable Interest Rates

Fixed interest rates remain constant throughout the loan term, providing borrowers with predictable monthly payments. On the other hand, variable interest rates fluctuate based on market conditions, potentially leading to lower initial rates but also posing the risk of increased payments over time. Borrowers need to weigh the pros and cons of each type of interest rate based on their financial goals and risk tolerance. While fixed rates offer stability, variable rates may provide opportunities for savings if interest rates decrease. It’s essential for borrowers to carefully consider their options and choose the type of interest rate that best aligns with their financial situation and long-term objectives.

Eligibility Criteria for Low Interest Personal Loans

When applying for low interest personal loans, there are certain eligibility criteria that borrowers need to meet in order to qualify for favorable interest rates.

Common Eligibility Requirements

Some common eligibility requirements for securing low-interest personal loans include:

- Good credit score: Lenders typically offer lower interest rates to borrowers with a good credit history, as it indicates their ability to repay the loan on time.

- Stable income: Having a steady source of income assures lenders that you can make timely repayments.

- Low debt-to-income ratio: Lenders prefer borrowers with a low debt-to-income ratio, as it shows that you can manage your existing debts responsibly.

Documents Required

When applying for a low interest personal loan, applicants may need to submit the following documents or information:

- Proof of identity: Such as a driver’s license or passport.

- Proof of income: Pay stubs, tax returns, or bank statements.

- Credit history: Lenders may check your credit report to assess your creditworthiness.

Co-Signer Impact on Interest Rates

Having a co-signer for a personal loan can potentially help you secure a lower interest rate. A co-signer with a good credit score and stable income can reassure the lender of timely repayments, leading to a reduced interest rate on the loan.

Tips for Securing Low Interest Personal Loans

When looking to secure a low interest personal loan, there are several strategies and tips that can help improve your chances of getting a favorable rate and terms.

Improving Credit Scores

One of the key factors that determine the interest rate you’ll be offered on a personal loan is your credit score. To secure a low interest rate, it’s essential to work on improving your credit score. Here are some tips:

- Pay your bills on time to avoid late payments which can negatively impact your credit score.

- Reduce your credit card balances to lower your credit utilization ratio.

- Check your credit report regularly for errors and dispute any inaccuracies to improve your score.

- Avoid opening new credit accounts before applying for a personal loan.

Negotiating with Lenders

When applying for a personal loan, don’t be afraid to negotiate with lenders to secure better terms. Here are some tips for negotiating a lower interest rate:

- Shop around and compare offers from different lenders to leverage competitive rates.

- Highlight your creditworthiness and financial stability to demonstrate your ability to repay the loan.

- Consider offering collateral or a co-signer to strengthen your application and secure a lower rate.

- Ask about any loyalty discounts or special promotions that may be available to you as a customer.

Comparing Loan Offers

Before committing to a personal loan, it’s crucial to compare different loan offers to find the best low-interest option that suits your needs. Here’s how you can effectively compare loan offers:

- Compare the APR (Annual Percentage Rate) of each loan to understand the total cost of borrowing.

- Consider the loan term and monthly payments to ensure they fit within your budget.

- Review the fees and charges associated with each loan to avoid any unexpected costs.

- Read the fine print of the loan agreement to understand the terms and conditions before signing.

Summary

In conclusion, low interest personal loans present a valuable opportunity for individuals seeking affordable financing options. By understanding the key factors and strategies discussed, you can make informed decisions to secure the most favorable loan terms.